Food For Thought

Food For Thought

"Truth Is What Matters"

© copyrighted

Hello Washington Politicians ---

Putting People Back To Work Will Solve

The Deficit Crisis and Save Social Security !

The Facts and Truth You Need To Know America !

| by columnist

David Lawrence Dewey

"Reading provides knowledge...

knowledge leads to answers."

July 15, 2011 |

SEARCH

HOME

Previous Columns |

DO NOT POST THIS ARTICLE ON ANY MESSAGE BOARD IT IS COPYRIGHTED.

You can use this URL to link to this column: http://www.dldewey.com/jobs.htm

Send an email with this link: http://www.dldewey.com/jobs.htm to your family and friends.

Before I get to my column, I would like for everyone to read what Thomas Jefferson said in 1802:

"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property - until their children wake-up homeless on the continent their fathers conquered."

Also - make sure you read my column from 2004,

The Truth About The Job Loss In America - More Job LossesTo Follow - February, 2004.

I reported in 2004 and warned what would be happening over next 4-5 years. I warned of the mortgage loan meltdown and why it would happen and how to protect yourself then from losing much of your retirement funds. I also presented the facts as to why we where losing jobs in America that had been here for 75 years.

A DL DEWEY Exclusive

Report

Report

After reading this article, you can post your comments on the message board.

Click on Message Boards above, select: Putting Americans Back To Work and post your comments.

UPDATE 7-29-11

Before I get to my current column, I really need to clarify disinformation that Rush Limbaugh, Sean Hannity, Karl Rove and several Tea Party elected Congressman, ( the ones holding up the debt ceiling crisis) are telling people that President Obama has been on a spending spree and that the debt has risen more since Obama has been President than any other President. That is 100% incorrect and is a lie ! I have had it with these talking heads and politicians that are talking out of their you know what - just to stir people up. Limbaugh and Hannity has television and radio programs and how they keep their shows it by ratings and how they keep their ratings up is by telling me people lies, what people want to hear and not the facts. Good lord people, wake up !

Here are the real facts:

The statutory limit on federal borrowing was first established with the Second Liberty Bond Act of 1917, which helped finance the nationís entry into World War I, according to the Congressional Research Service. That act allowed separate limits for different forms of debt.

In 1939, Congress eliminated separate limits. It set up the first aggregate limit covering nearly all public debt. During the presidency of Franklin D. Roosevelt, the debt ceiling was raised annually between 1941 and 1945 to pay for the costs associated with World War II. The limit was increased to $65 billion in 1941.

When the debt limit was increased to $300 billion in April 1945, Truman became president. The debt ceiling was reduced to $275 billion in June 1946, and the Korean War was primarily financed by higher taxes, not increased debt. Something I want to point out very clear that President Bush borrowed over $2 trillion dollars before he left office to finance the Iraq and Afghanistan wars. With an additional nearly $500 billion being giving to countries like Pakistan, India, Turkey and other countries to fight his "war on terror". HELLO ? So just who has been spending....spending...spending?

The debt ceiling did not increase until 1954, when Dwight D. Eisenhower was president.

From Eisenhower to former President George W. Bush, the debt ceiling was raised during every presidency for a total of 68 times according to data from the White Houseís Office of Management and Budget. DATA.

This is (46) times Republican Presidents have risen the debt - versus (22) times that Democrat Presidents have raised the debt ceiling from Eisenhower to George W.Bush.

Obama has requested Congress to raise the debt limit three times since he has been President. Once was for $780 billion to stop the mortgage financial banking meltdown crisis that was primarily caused by Reagan and the Newt Gingrich crowd when they deregulated the banking industry and opened up pandora's box and let crooks into the banking industry. Read my columns below that give you all the facts and truth concerning this.

Here are the real facts concerning debt ceiling increases before Obama by presidency:

- Dwight D. Eisenhower (R): 4

- John F. Kennedy (D): 5

- Lyndon B. Johnson (D): 7

- Richard M. Nixon (R): 7

- Gerald R. Ford (R): 6

- Jimmy Carter (D): 6

- Ronald Reagan (R): 18

- George H. W. Bush (R): 5

- Bill Clinton (D): 4

- George W. Bush (R): 8

When Eisenhower left office, the debt limit was $293 billion. After Bush left office following seven increases to the debt ceiling, the country's debt was at $11.3 trillion. Today it is $14.3 trillion, so under the Obama Presidency, it has increased $3 trillion dollars, of which nearly $500 billion of that has been the cost of fighting the Iraq and Afghanistan wars. Those are the real facts people and if you keep believing what these talking heads are telling you, then all I can

say is, God Help This Country because of idiots.

By the way, I'm registered as an Indepedent and do I agree with all that President has and has not done,

NO! I am stating this so that people cannot label me as a liberal protecting President Obama. What I am doing is telling you the truth and facts and because I do not like anyone to be attacked with disinformation as these talking heads are doing to President Obama. Hello America,...why are you listening to these talking heads that are only using you ? Wake up - go out and research and find what the real facts and truth really is.

I have truly had it with the stupidity that is going on in this country - all being created out of FEAR and these talking heads are making you FEARFUL with disinformation.

And one last comment - where were all these Tea Party Activists during the Reagan years and the Republican controlled Senate and House that spent...spent...spent...raising the debt ceiling (18) times ? ? Where where they when Bush and the Republican controlled House and Senate raised the

debt ceiling 8 times ? ? If you look at the data above, Republicans have raised the debt ceiling more than the Democrats. Why...because it is the Republicans who have been spending...spending...spending. Remember the $2 million dollar bridge to NOWHERE in Alaska 3 years ago? And now they are trying to blame President Obama. Hello America ! What's wrong with this picture? America are you that ignorant to fall for this nonsense and disinformation or are you smart enough to know the real facts and truth.

Well...here are the real facts and truth...it's up to you America...now...to my current column

Putting People Back To Work Will Resolve Deficit and Save Social Security

The Facts You Need To Know America

David Lawrence Dewey - July 15, 2011 © copyrighted

America, you are not being told the facts and truth concerning how America got into this deficit problem and Social Security crisis. You are being dumbed down by all of the politicians using scare tactics regarding Social Security instead of addressing the facts with truth and integrity of which I will present to you in this article. I am so tired of the political double speak by the Republicans that it is President Obama's spending that has gotten the country into this mess. No, it was 8 years of George W. Bush getting America into two wars costing $1.4 trillion dollars to date and which is still costing nearly $6 billion dollars a month today.

I'm also tired of the Democrats saying it is the Republicans fault beause they won't raise taxes on the wealthy. After you read the facts and truth in this article, I hope you will take action and start calling, emailing and writing your elected politicians to stop all this stalling and get around to fixing the problems.

I will also spell what has caused the problems with the facts and truth you have not been told and present the solutions to fix the deficit, restore Social Security and Medicare, but America... it is going to be up to you to take this information, these facts and truths and empower yourself and do something about it with your elected politicians who are playing games with you. And I am tired of listening to politicians that cannot get the history of our country correct and are making up their own history. Who elects these people? Idiots?

HERE ARE THE FACTS:

- Social Security and Medicare are not going broke, but will and the reason why has been because of politician incompetence and I will spell out who is to blame with the facts and truth! Medicaid is a completely different mess and that is why we need a National Health Care insurance program.

- Of the $14 trillion dollar deficit, included in that is $4.3 trillion that the U.S. Government owes the Social Security Trust Funds and other entitlement funds like the Railroad Retirement Fund.

- Of the $14 trillion dollar deficit, since 2001 the Iraq and Afghanistan wars have cost Americans $2.0 trillion dollars or nearly $8 billion a month to this day.

Breakdowns:

COST OF IRAQ WAR - Update July 15, 2011 - $797 billion dollars through September 30, 2010

DAILY COST OF AFGHANISTAN WAR - Update July 25, 2011 - $460 billion through September 30, 2010

Each month it is another $8 billion dollars, or $100 billion a year.

Since September 30, 2010, another $80 billion dollars has been spent on both wars.

As of June 30, 2011 , both wars have cost the U.S. $2.0 TRILLION DOLLARS

It is estimated by the time we pull out all troops from both countries, it will have cost the U.S. over $4 trillions dollars.

Thank you George W.Bush.

Source: http://costofwar.com/en/

* The above site is only through September 30, 2010 and compiled from Defense Budgets.

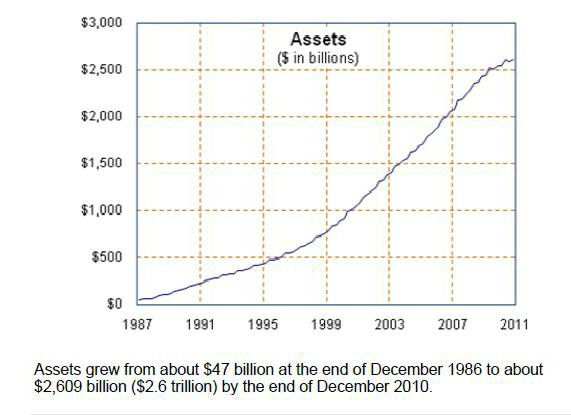

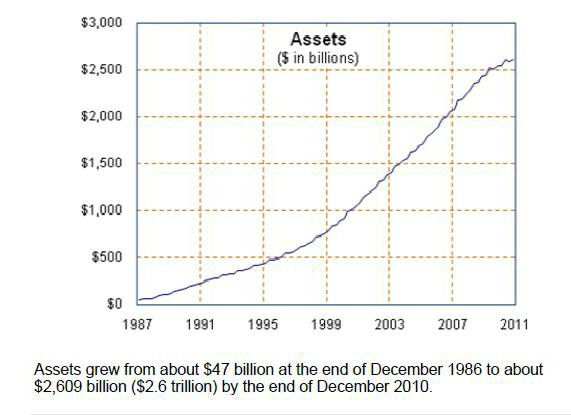

- Social Security Trust Funds have increased from $47 billion in 1986 to $2.6 trillion as of December 2010 , yet the government continues to put I.O.U.'s in the box to fund the wars.

Source: http://www.ssa.gov/OACT/ProgData/assets.html

- 8.84 million jobs have been lost since 2000 in all areas of job employment due to corporations shutting down plants in the U.S. and moving overseas. This is due to the corporate tax loopholes passed during 2001 to 2005.

Read my column from 2004...

The Truth About The Job Loss In America - More Job LossesTo Follow - February, 2004.

I reported in 2004 and warned what would be happening over next 4-5 years. I warned of the mortgage loan meltdown and why it would happen and how to protect yourself then from losing much of your retirement funds. I also presented the facts as to why we where losing jobs in America that had been here for 75 years.

- According to the 2000 Census, of the 139 million people in the labor force, 130 million were employed, 8 million were unemployed, and 1.2 million were in the Armed Forces. The civilian unemployment rate was 5.8 percent.

Source: http://www.census.gov/prod/2003pubs/c2kbr-18.pdf

- However, according to the Social Security Adminstration in January, 2000, 155.2 million Americans were paying into Social Security. 45.1 million were collecting benefits.

Source: http://ssa.gov/pubs/10024.html

Source: http://www.ssa.gov/history/ratios.html

- Okay, which department do you believe is more accurate? It is the Social Security data because they know the number of people paying into the system versus a census based on people supposedly telling the truth on the census regarding their employment. Remember, federal tax dollars are appropriated on many factors to the states, one being the labor force and employment and unemployment, so is this why the Census numbers are lower than Social Security actual data?

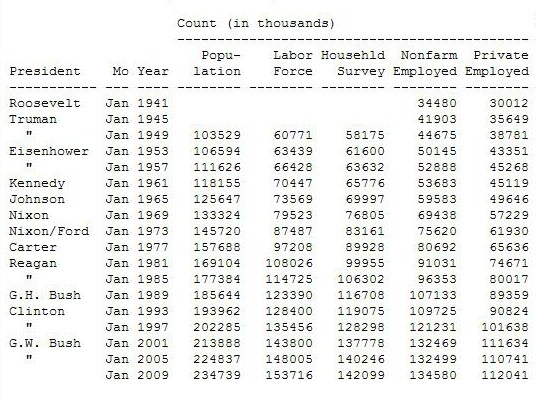

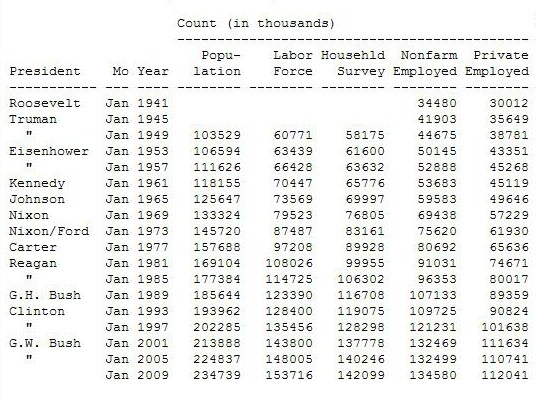

What we have to know is the growing job force within a growing population. Below are the totals of population growth, labor force growth for the years 1941 through 2009. It lists the population of the country, the growing work labor force, how many Americans were employed, etc. It also lists who the President was at the time. Below also is a more detailed information of who the President was and who controlled the Senate and House every time a rate increase of social security taxes was done. Do you think it was the Democrats raising the social security taxes the most? If you say it is the Democrats, you are wrong. It was the Republicans.

The U.S. population in January, 2000 was 211.4 million people.

Source: Bureau of Labor Statistics: http://www.bls.gov/

Here is a .pdf copy of all information contained in this article from the BLS. The BLS has not released 2010 data yet.

U.S. Employment-Population 1939 to January 2009.

The U.S. population in January 2009 was 234.7 million people.

This is a growth of 23.3 million people in the population over these ten years,average 2.3 million people a year.

Now what was the labor force, meaning more people entering the labor force less those retiring

In January 2000, the labor force, people looking for work was 142.2 million people.

Ten Years later:

In January 2009, the labor force, people looking for work was 153.7 million people.

This was a growth of 11.5 million more people entering the work force during these ten years, but wait, how many jobs were lost during these ten years of jobs going overseas?

8.84 million people lost jobs during these years due to corporations shutting down factories in the U.S. and moving operations overseas while there was approximately 11.5 million young people entering the labor force during these ten years.

So, in January 2009, you have a total of 11.5 million people due to population growth plus 8.84 million people who have lost their jobs due to outsourcing over these ten years, this is a total of what....nearly 20 million people looking for jobs.

In January 2000, 130.7 million people had jobs.

In January 2009, 134.5 million people had jobs.

This was the creation of only 3.8 million jobs over these ten years, in addition to a 8.84 million job losses.

What was the unemployment rate in January 2000 - 4.0% of the force force = 5.7 million people looking for work.

What was the unemployment rate in January 2009 - 7.6% of the work force = 11.6 million people looking for work.

This is a 110% increase in the unemployement rate, or an increase of nearly 6 million people looking for work.

So, now do you see the problem America? Do you see how you have been lied to? There was a 11.5 million increase in the work force from January 2000 to January 2009 of people looking for work due to population growth in addition to 8.84 million jobs lost overseas by corporations moving operations out of the country, but only a net gain of 3.8 million jobs created over these ten years. 11.5 + 8.84 - 3.8 = a 16.5 million job shortage. If the 8.84 million jobs had not left the U.S. during these ten years, the people looking for work would only be 7.7 million people out of a labor work force of 153.7 milion people, the employment rate would today be around only 5.1 % not the current rate of 9.4% as of June 2011 according to the Bureau of Labor Stastistics. Keep in mind this is data only through 2009. The population since 2009 has grown approximately 12 million entering the work force, so that is making the situation even worse.

So, now that you have the "real" facts, do you understand what the problem is?

How has this affected the Social Security Trust Funds? - DRAMATICALLY !

If you have less people working, you have less people paying into Social Security. It is no different than running a business, if you don't have the sales, you can't pay your employees - correct?

What are the solutions that the politicians in Washington should be concentrating on instead of all this arguing back and forth between political ideologies of either NO increase in taxes and or cutting funding for much needed programs like Social Security and Medicare.

HELLO WASHINGTON POLITICANS ARE YOU LISTENING ? - IT'S ABOUT JOB CREATION

If you have more people working paying into the system, it will resolve the crisis in the Social Security Trust Funds and Medicare.

This is NOT what you are being told that needs to happen by the politicians because then they will have to admit that they let 8.84 million jobs leave this country and for what reason? Corporate pay back time to the corporations that elected them is why.

The reason why the projections look so bad regarding the Social Security Trust Funds is the lost revenue of social security taxes of these 9 million unemployed people who lost there jobs over this time period. Instead, politicians are scaring you with, "Social Security is going broke." Politicians have been playing and are still playing political dogery at your expense again, don't fall for it. They are not telling you the truth that this is the problem because then they will have to explain why they let corporations shut down factories and move overseas with huge tax credits and the profit they make overseas are NOT taxed as well, another tax loophole that President Obama is trying to fix but the Republicans are pro business usual and not budging on this.

Let's take a history lesson on who increased Social Security taxes over the years since 1940.

First, you need to know what the payroll tax Social Security was for each year since 1940.

TAX RATES: http://www.ssa.gov/policy/docs/statcomps/supplement/2010/2a1-2a7.html#table2.a3

Total Employer and Employee Contribution - Ĺ of rate listed is employee contribution that is deducted from paychecks

Since 1950, the social security tax has been raised by the following:

(5) Republican Presidents raised social security taxes (8) times

(2) Democrat Presidents rasied social security taxes (3) times

Democrats controlled both the House and Senate from 1950 thru 1980 except for one session during this time period.

Republicans controlled the Senate from 1981 to 1987

Democrats controlled the House from 1981 to 1987

In 1987 Republicans captured both the Senate and House and held both until 1995 until 2007 - 12 years.

These were the infamous, "Newt Gingrich years - Contract With America" fiasco.

Democrats took control of both House in 2008 until 2010 election when the Republican took control of the House and Democrats still controlled the Senate.

Here are the social security tax rates when they were increased and who was President and who controlled the House and Senate.

- 1951 - 2.25% - Eisenhower ( Republican ) was President - Democrats controlled House and Senate

- 1960 - 4.50% - Eisenhower ( Republican ) was President - Democrats controlled House and Senate

- 1965 - 5.40% - Johnson ( Democrat ) was President - Democrats controlled House and Senate

- 1967 - 6.40% - Johnson ( Democrat ) was President - Democrats controlled House and Senate

- 1970 - 6.90% - Nixon ( Republican ) was President - Democrats controlled House and Senate

- 1972 - 7.50% - Nixon ( Republican ) was President - Democrats controlled House and Senate

- 1980 - 8.10% - Carter ( Democrat ) was President - Republicans controlled House and Senate

- 1982 - 9.35% - Reagan ( Republican ) was President - Republicans controlled House and Senate

- 1984 - 14.0% - Reagan ( Republican ) was President - Republicans controlled House and Senate

- 1988 - 15.2% - Reagan ( Republican ) was President - Republicans controlled House and Senate

- 1990 - 15.3% - Bush One ( Republican ) was President - Republicans controlled House and Senate

- The Social Security tax has not been raised since 1990 - why is that?

How Long Has Congress and Each President Known Something Needed to Be Done About Social Security?

It goes all the way back to 1940 in the Social Security Adminstration Reports to Congress and Presidents. Below are

just some of them, but every year since 1940, the issue of social security solvency has been raised by the Trustees of

the Social Security Trust Funds.

Social Security Trust Funds Reports 1941 and Estimates thru 1945

Source: http://www.ssa.gov/history/reports/trust/tf1941.html

Social Security Funds were invested in Treasury Bonds back in 1942 then paying 3% special interest as set by Congress then. Today the Treasury is paying up to 11.35% interest on borrowed Socdial Security Funds. This is insane. The Governement is creating MORE debt by borrowing against the Social Security Funds. However, this is no different than

selling Treasury Bonds to the China government, paying the same high amount. This just means that we are not in debt as much to the China governement, instead, Americans are footting the Iraq and Afghanistan Wars through the Social Security Trust Funds.

Report Issued January 3, 1941 - In this first report, they knew in 1941 something needed to be done regarding Social Security.

Here are other the other yearly reports:

All Trust Funds Reports 1942 - 1994

http://www.ssa.gov/history/reports/trust/trustyears.html

1995 - 1996 reports

http://www.ssa.gov/history/reports/trust/trustreports2.html

1997 - 2011

http://www.ssa.gov/OACT/TR/index.html

2010 Summary

http://www.ssa.gov/OACT/TRSUM/tr10summary.pdf

Below is what each Conclusion states in each summary report. Pay attention to the BOLD

2000 Summary

http://www.ssa.gov/OACT/TR/TR00/tr00.pdf

Conclusion: ( My comment: Thru 1999 the Trust Funds were experiencing continued growth - however that changed in 2001 when the first of the massive jobs losses in the country began to be seen in the social security trust funds )

During fiscal year 1999, total receipts amounted to $67.8 billion, and total disbursements were $52.1 billion. The assets of the trust fund thus increased by $15.7 billion during the year, to a total of $92.7 billion on September 30, 1999.

Net contributions thus amounted to $61.9 billion, an increase of 6.8 percent from the amount in the preceding fiscal year. This increase is attributable to the same factors, insofar as they apply to the DI program, that accounted for the change in contributions to the OASI Trust Fund. Income from the taxation of benefit payments amounted to $0.6 billion in fiscal year 1999.

Interest totaling $5.2 billion consisted of interest on the investments of the fund, interest on amounts of interfund transfers, and interest on reimbursements. Of the $52.1 billion in total disbursements, $50.4 billion was for net benefit payments. This represents an increase of 6.0 percent over the corresponding amount of benefit payments in fiscal year 1998. This increase is due in part to the same factors that resulted in the net increase in benefit payments from the OASI Trust Fund. However, the number of persons receiving benefits from the DI Trust Fund increased more rapidly in 1999, than those receiving benefits from the OASI Trust Fund.

Now close pay attention to this report issued in 2001. Bush Two was President then. This is where the Trustees recommend an increased of the tax to 14.26% or a reduction of benefits of 13 percent. What did I just say. A reduction of 13 percent. They have been talking about reducing benefits since 2001 or the tax rate had to be increased . Did you know that? Did your politicans tell you about this then? NO ! Bet you didn't know this did you? And who was in control of both the Senate and the House, the Republicans, the Newt Gingrich crowd - Contract With America. Right and we have all seen how that turned out ! How do you feel about finding this out now?

2001 Report - Page 198

Source: http://www.ssa.gov/OACT/TR/TR01/tr01.pdf

Pay attention to the BOLD below - they were told to increase the rate in 2001.

Did President Bush Two and the Republican controlled Senate and House tell you about this? --- NO !

Conclusion

Over the full 75-year projection period the actuarial deficit estimated for the combined trust funds is 1.86 percent of taxable payroll, a small improvement from the deficit of 1.89 percent projected in last year's report. This deficit indicates that financial adequacy of the program for the next 75 years could be restored (under the Trustees' best estimates), if the Social Security payroll tax were immediately and permanently increased, from its current level of 12.4 percent (combined employee-employer shares) to 14.26 percent. Alternatively, all current and future benefits could be reduced by about 13 percent

(or there could be some combination of tax increases and benefit reductions).

And here is the same recommendation by the Trustees of the Social Security Trust funds again. the combined payroll tax rate could be increased during the period in a manner equivalent to an immediate and permanent increase of 1.70 percentage points, benefits could be reduced during the period in a manner equivalent to an immediate and permanent reduction of 11.5 percent,

Did you hear about this in 2003 by President Bush and the Republican controlled Senate and House - the New Gingrich crowd. --- NO !

In 2003 Report - Page 11

http://www.ssa.gov/OACT/TR/TR08/tr08.pdf

Conclusion

Annual cost will begin to exceed tax income in 2017 for the combined OASDI Trust Funds, which are projected to become exhausted and thus unable to pay scheduled benefits in full on a timely basis in 2041 under the long-range intermediate assumptions. For the trust funds to remain solvent throughout the 75-year projection period, the combined payroll tax rate could be increased during the period in a manner equivalent to an immediate and

permanent increase of 1.70 percentage points, benefits could be reduced during the period in a manner equivalent to an immediate and permanent reduction of 11.5 percent, general revenue transfers equivalent to $4.3 trillion in present value could be made during the period, or some combination of approaches could be adopted. Significantly larger changes would be required to maintain solvency beyond 75 years.

And here again in 2005, the Trustees recommend either raising the tax or reducing benefits 13 percent. if the Social Security payroll tax were immediately and permanently increased from its current level of 12.4 percent (for employees and employers combined) to 14.32 percent. Alternatively, all current and future benefits could be immediately reduced by about 13 percent

Did you hear about this from the Republican controlled Senate and House in 2005. -- NO !

2005 Report - Page 24

http://www.ssa.gov/OACT/TR/TR05/tr05.pdf

Conclusion

Over the full 75-year projection period the actuarial deficit estimated for the combined trust funds is 1.92 percent of taxable payroll-slightly higher than the 1.89 percent deficit projected in last year's report. This deficit indicates that financial adequacy of the program for the next 75 years could be restored if the Social Security payroll tax were immediately and permanently increased from its current level of 12.4 percent (for employees and employers combined) to 14.32 percent. Alternatively, all current and future benefits could be immediately reduced by about 13 percent.Other ways of reducing

the deficit include making transfers from general revenues or adopting some combination of approaches. If no action were taken until the combined trust funds become exhausted in 2041, much larger changes would be required.

And here we are again in 2005 above and below in 2007, the Trustees of the Social Security Trust Funds recommend raising the social security tax or reducing benefits, For the trust funds to remain solvent throughout the 75-year projection period, the combined payroll tax rate could be increased during the period in a manner equivalent to an immediate and permanent increase of 1.70 percentage points, benefits could be reduced during the period in a manner equivalent to an immediate and permanent reduction of 11.5 percent.

Did you hear about this from the Republican controlled Senate and House? -- NO !

2007 Report - Page 18

Source: http://www.ssa.gov/OACT/TR/index.html

Conclusion

Annual cost will begin to exceed tax income in 2017 for the combined OASDI Trust Funds, which are projected to become exhausted and thus unable to pay scheduled benefits in full on a timely basis in 2041 under the long-range intermediate assumptions. For the trust funds to remain solvent throughout the 75-year projection period, the combined payroll tax rate could be increased during the period in a manner equivalent to an immediate and permanent increase of 1.70 percentage points, benefits could be reduced during the period in a manner equivalent to an immediate and permanent reduction of 11.5 percent, general revenue transfers equivalent to $4.3 trillion in present value could be made during the period, or some combination of approaches could be adopted. Significantly larger changes would be required to maintain solvency beyond 75 years. The projected trust fund deficits should be addressed in a timely way to allow for a gradual phasing in of the necessary changes and to provide advance notice to workers. Making adjustments sooner will allow them to be spread over more generations. Social Security plays a critical role in the lives of 50 million beneficiaries and 164 million covered workers and their families in 2008. With informed discussion, creative thinking, and timely legislative action, present and future Congresses and Presidents can ensure that Social Security continues to protect future generations.

I have provided these facts to wake you up America. While the Republicans controlled Senate and House from 2000 through 2008 with a Republican Presdient was giving away America to the corporations, they were not taking care of you. They sat back and let nearly 9 million jobs leave this country. They loosened more banking regulations that Reagan has deregulated the banking industry that caused the financial meltdown we have seen. Read my column job loss column above and you'll learn the facts about that.

Now that you know the real truth and facts, how do we tell the politicians to solve our deficit and take care of Social Security. The information I have provided only deals with Social Security, not Medicare, however, this solution will resolve both problems. Now are the Democrats since 2000 not to blame as well as the Republicans who had control of both the Senate and House and who should have taken steps during the eight years of the Bush Presidency. Yes, the Democrats are just as much to blame because they sat there and did not tell you, the American voter the facts, the truth as you have read in this article.

Hello Washington Politicians - Stop All The In-Fighting - NOW

It is about creating jobs. Why are they not taking steps to do this?

This is what needs to be done to resolve our crisis in this country, resolve the deficit, restore Social Security and Medicare.

- Do away with the tax loopholes for corporations and the wealthy.

- Put back into place tarriffs on imports.

- The Banking Regulations that were done away with by the Reagan years and Republicans needs to be put back in place. I wrote about this in my article,

The Truth About The Job Loss In America - More Job LossesTo Follow - February, 2004.

I reported in 2004 and warned what would be happening over next 4-5 years. I warned of the mortgage loan meltdown and why it would happen and how to protect yourself then from losing much of your retirement funds. I also presented the facts as to why we where losing jobs in America that had been here for 75 years. I also gave in detail what the Reagan banking deregulation years and how deregulation opened up Pandora's box and let the crooks into the

banking environment unsupervised.

- This Needs To Stop - Executive Pay At Big Companies Rose 23% Last Year

Do you know they pay less tax than the average middle class working American because of tax loopholes?

The final figures show that the median pay for top executives at 200 big companies last year was $10.8 million. That works out to a 23 percent gain from 2009. The earlier study had put the median pay at a none-too-shabby $9.6 million, up 12 percent.

The average American worker was taking home $752 a week in late 2010, up a mere 0.5 percent from a year earlier. After inflation, workers were actually making less. What's wrong with this picture? TAX LOOP HOLES for corporations that Obama is trying to get fixed, but who is blocking him?

On this yearís list, the highest-paid C.E.O. was Philippe P. Dauman of Viacom, who made $84.5 million in just nine months. (Viacom changed its fiscal year-end to September from December.)

Ray R. Irani, the C.E.O. of Occidental Petroleum, who took home $76.1 million last year, up 142 percent from the previous one. Last year, the board awarded Mr. Irani a $33 million cash bonus plus $40.3 million in stock awards, more than double what he received in 2009.

Lawrence J. Ellison of Oracle, the software giant, followed close behind, with a $70.1 million payout, though that is down 17 percent from 2009. Still, Mr. Ellisonís fortunes are just fine: he had more than $26.3 billion in stock and other holdings in Oracle in 2010.

John F. Lundgren, chief executive of Stanley Black & Decker, whose pay rose 253 percent, to $32.57 million, after a huge stock award. His counterpart at Emerson Electric, David N. Farr, saw his pay rise 233 percent, to $22.9 million, also because he was granted millions in stock.

FordMotor, Alan R. Mulally, made $26.5 million in total pay, up 48 percent over the previous year as a result of big stock option awards.

Leslie Moonves, of the CBS Corporation, got a 32 percent raise and reaped $56.9 million.

Michael White of DirecTV was paid $32.9 million, while Brian L. Roberts of the Comcast Corporation and Robert A. Iger of the Walt Disney Company each received pay packages valued at $28 million.

Other big payers included oil and commodities companies like ExxonMobil.

GreggW. Steinhafel of Target, who had a $23.5 million pay package; Michael E. Szymanczyk

of Altria, $20.77 million; and Richard C. Adkerson of Freeport-McMoRan Copper & Gold, $35.3 million.

Warren E. Buffett, for instance, saw his stock holdings rise last year by 16 percent, to $46 billion. Other longtime chief executives or founders who are sitting on billions of paper profits include Jeffrey P. Bezos of Amazon.com and Michael S. Dell, the founder of Dell.

- The present cumbersome and unfair Federal Income tax systems needs to be replaced with a National Flat Income Tax. I'll explain that in more detail below.

- We must get out of Iraq and Afghanistan, the U.S. taxpayer cannot afford nearly $6 billion dollars a month any longer.

President Bush, while in office two terms increased federal spending 21% and the Republicans who were in control of Congress during this time participated in this --- they continue to hawk for more tax reductions for the big corporations, especially the banking corporations. The real truth in these so called tax reductions, the average American worker is getting much less than those earning $200,000 or more a year. The Bush Administration while all the while talked about less government boosted the number of people working in the Federal Goverment to a 15 year record high. And on top of this all, he started a war that has cost $87 to $90 billion dollars a year since he started it.

- We need bridges rebuilt in this country, they are falling apart. We need a new electrical grid system built. Water pipes in major cities are 100 years old needing replacing. President Obama is correct in insisting on money to rebuild our infrastructure. This would immediately put people to work and create other jobs. Who is hoilding this up - the Republicans and the newly elected Tea Party nutcases in Congress.

- And my fellow Americans... you have to do one thing yourself and for this country and for your fellow American who does not have a job...

- You must stop buying all this crap made in China and overseas and start buying Made in America.

Do you know that for every ten products that Americans buy made overseas, it has cost (1) American their job!

And last...we need to look at a flat National Income Tax instead of this regressive present tax system that provides loopholes and means for corruption. The middle class gets burned the most with the present tax system. It would be a simple flat tax on the wages a person earns, taken out of paychecks. No yearly income tax filing. Corporations would pay a flat amount on Total Revenues, period. NO more corporate tax filing. That alone would save over $44 million in doing away with the IRS. A flat tax is a more fair tax for all. All Americans derive the benefits that this great country provides. Transit systems, highways, national parks. A flat tax is the only fair tax there is. And it would force the politicians to really balance the budget. No more pork barrel projects.

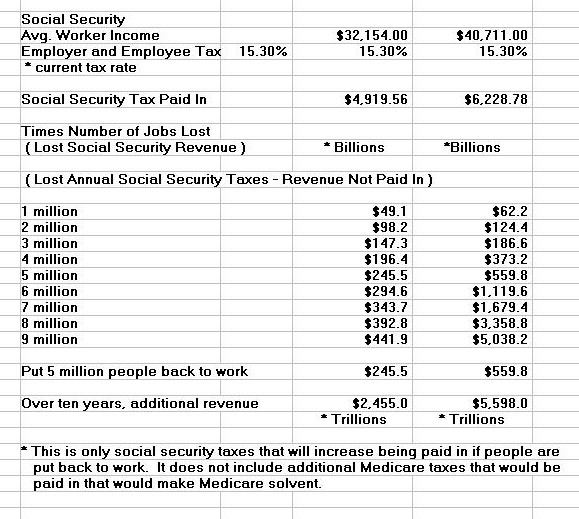

Below are the figures to prove it! Now it may mean a slight increase of less than 1/2 percent in the social security tax, but if the Republicans would stop blocking the removal of all the corporate tax loopholes, there would not have to be a tax increase on social security or a reduction of benefits.

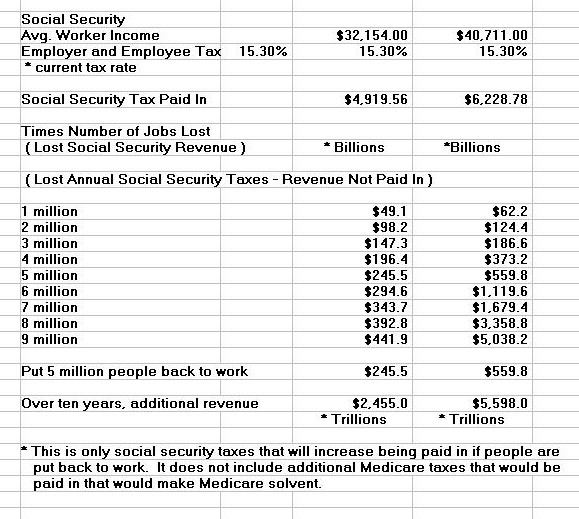

THE IMMEDIATE SOLUTION

PUT PEOPLE BACK TO WORK TO RESOLVE THE DEFICIT AND RESTORE SOCIAL SECURITY AND MEDICARE

As shown in the spreadsheet below, if we put back to work 9 million people, this would generate over tens years between $2.4 and $5.5 trillion dollars in social security tax revenue for the Social Security Trust Funds. This is based on figures the Social Security Administration shows has been the average income per worker paying into social security on wages between $32,154 and $40,711 annual wages. This does not include the additional Federal and State income taxes it would generate by putting these people back to work which would reduce the federal deficit and ease the budget crisis problems in individual States.

Source: http://www.ssa.gov/oact/cola/AWI.html

Here is a recap of my other articles. They provides all the facts. You may not like them, but they are the real facts. Americans tend to forget what has happened in the past.

The Banking Meltdown - The Cause

Carter, Reagan, Bush, Clinton and another Bush...

Deregulation and the Slippery Road to Poisoned Assets

The Banking Meltdown

The U.S. now owes CHINA nearly $1.2 trillion dollars. Find out why. Read the facts about Reagan's banking deregulation that caused the financial meltdown, deregulation opened up pandora's box to let the crooks in.

From 1998 to 2009, over 3,000 U.S. based call centers closed, going overseas to such places as Pakistan, India, resulting in over 215,000 jobs lost.

Over 1,400 textile linen/fabric plants and 1,100 clothing manufacturing plants closed uring this same time frame, resulting in over 245,000 more jobs lost.

In 1992, Florsheim Shoes Inc. also closed factories in Illinois and other states, 3,500 jobs lost.

And this is just the tip of the iceberg America !

Bethelem Steel filed bankrputcy in 2005, a 125 year old steel foundry in the U.S. had to shut down because the U.S. Government in 2002

started purchasing steel from CHINA to make tanks, military equipment, even bullets for the Iraq and Afghanistan Wars.

Many sheet rock factories closed in the U.S. during the housing boom because it could be bought cheaper in China. The result, over 100,000 homes it is estimated have sheetrock made in China that is making people sick due to the chemicals in it.

I warned people in 2004 of what was coming.

The Truth About the Jobs Losses and More to Follow

Job Losses - 2004 - More to Follow

I warned people again in 2008:

Job Loss Hits Records Highs

Job Losses Hit Record Highs

Americans Need To Accept The Reality of The Problems

Accept Reality

Total jobs lost from 1998 thru 2009 8.84 million jobs lost in manufacturing and other jobs due to companies going overseas and closing plants in U.S.

Keep in mind that by losing these jobs, you use a multipler to calculate additional jobs lost that these jobs also created.

The multipiler is .5 additional jobs were lost for every job lost another words...another 4.42 million related and additional jobs the 8.84 million jobs lost.

So...the total real "jobs" lost during this period was a total of 13.2 million jobs actually lost FOREVER during these (11) years!

This represents $100,000 in lost National Income per job, or a total of... $1 trillion, 320 billion annual lost National Income/Wealth to Americans. And I stress jobs/National Income lost FOREVER! !

How much are going to take of this middle America... Until you are homeless on the street and then unable to do anything about it? Stop voting for the same lying politicians time and time again! Don't you get it by now, these politicians don't give a damn about you middle America! And they wonder why there is less revenue/taxes being paid?

My final comment.

My fellow Americans, it is now up to you. You have the facts and truth now. What are you going to do about it? If you do nothing, then things are only going to get worse. The political dogery and lying in Washington will continue. More of your wealth will be taken away from you by politicians who DO NOT have your best interests at heart by any means. If they did, none of this that I have explained would have occurred.

I strongly urge you to call your Senators and Congressmen in Washington and demand these changes. Enough is enough! Locate your Senators and House of Representative to write them:

HERE

You can call your Elected Representatives at this Toll Free # (1-866) 220-0044 in Washington, D.C. - simply ask for the office of your Senator or House of Representative office or even the Assistant to President Obama and voice your outrage concerning this.

Do you remember Sam Walton, Founder of Walmart. He had these huge signs at the front of each store that said, "We only sell what is made in the USA." Within a year after his death, his heirs changed that philosophy that created jobs in America. The signs came down and Walmart started forcing companies to go overseas to make their products cheaper for Walmart. Result, the loss of over nine million jobs over the last ten years. Read my columns below about those facts.

Here is another fact that you probably are not aware of.

Hillary Clinton served on the Board of Walmart from 1986 until 1993. She was paid $18,000 a year to serve on the board. She had also accumulated at least $100,000 in Walmart stock. Hillary Clinton, whose husband was President Clinton knew in the 90's the mass exodus of jobs that was leaving the U.S. because of Walmart's policies of insisting that companies manufacture their products overseas. The details are in this Associated Press article,

March 12, 2006, reprinted on COMMON Dreams.org..

In 2004, Hilliary told an audience at the convention of the National Retail Federation that her time on the board ''was a great experience in every respect." I wonder why? She became wealthier while Americans were losing jobs because of Walmart and she knew it. And let's now forget that President Clinton also ignored ths mass exodus of jobs overseas. He pushed NAFTRA.

So, here is a short recap what has happened since Reagan. If you don't understand this, this you haven't understood any of the facts and truth I have given you.

- Reagan and the Republicans in the 1980's, deregulated banking thus letting crooks into the banking industry causing the financial mortgage meltdown of 2007-2008.

- George W. Bush and the Republicans fought any banking regulation which the Republicans still today are fighting Obama on.

- Clinton sat and did nothing and let the beginning the the mass job exodus from America start in 1992. By 1998, America was losing over 1/2 milion jobs a year due to the policies of Walmart and other companies, insisting companies make their products overseas. Clinton pushed and got NAFTRA, which added to the

loss of American jobs.

- George W. Bush let the mass job exodus continue while...

- Getting America into two wars costing over $2 trillion dollars while...

- He and the Republican controlled House and Senate like Reagan and the New Gingrich crowd, spent, spent, spent, putting America more into debt,

adding over $5.7 trillion to our national debt in his (8) years of the Presidency.

- Between these Bush (1), Reagan and Bush (1) , they alone raised the debt ceiling (23) times, raising our national debt from $909 billion when Regan took over frmo Carter. When Reagan left, the national debt has risen to $2.6 trillion dollars which Clinton took over. In just eight years Ronald Reagan had more than doubled what all the previous presidents since Washington through Carter had accumulated in the prior 200 years. Then came George Bush One. He left the country in debt to the tune of $4.1 trillion dollars. which Clinton took over. Despite the silicon valley economic growth, when Clinton left off the national debt was $5.6 trillion dollars. Then came

George W. Bush. During Bush two's 8 years, the debt rose from $5.6 trillion to $11.3 trillion which President Obama had laid in his lap.

- So, between Reagan, Bush one, they increased the national debt, $3.1 trillion dollars. Clinton due to the silicon valley economic boom, Clinton only increased the national debt to $5.6 trillion or $1.5 trillion dollars. Bush two increased it from $5.6 trillion to $11.3 trillion. So, we have three Republican President with most of the time a Republican controlled Senate and House that raised our national debt a total of, (Reagan, $1.6 trillion, Bush one, $1.5 trillion, Bush two, $5.7 trillion ), for a total of

$8.8 trillion dollars versus one Democrat President during these years that only raised the national debt $1.5 trillion dollars. What does that tell you America of who has really been doing the spending and why we are in this mess today. I am sorry, but the truth is the Republicans. Numbers do not lie do they?

I would like Rush Limbaugh, Sean Hannity, or Michelle Bachmann try to dispute these facts and most importantly try to explain why they are telling

people President Obama has been spending, spending, spending....WAKEUP AMERICA!

Here is a little tidbit about Michelle Bachman. She sure knew how to work the system in many ways.

Source: 2011-07-27, Washingtonpost.com

Bachmann Benefitted from Federal Home Loan Program

Like many members of Congress, Rep. Michele Bachmann has been a fierce critic of Fannie Mae and Freddie Mac, blaming the government-backed loan programs for excesses that helped create the financial meltdown in 2008. And like millions of other home purchasers, Bachmann took out a home loan in 2008 that offered lower costs to the borrower through one of the federally subsidized programs, according to mortgage experts who reviewed her loan documents.''

In addition, Bachman made over $480,000 dollars from both state and federal agencies taking care of "all those children" she did for seven and half years.

And now this woman along with (60) other Tea Party Activist elected nutcases that are going to destroy America. Hello America, what is wrong here?

Here is a list of the (60) Tea Party elected Congressman who are destroying America.

The caucus chairman is Michele Bachmann of Minnesota. As of March 31, 2011 the committee has 60 members, all Republicans.

Here are the people in Washington that is destroying America along with Eric Cantor from Ohio. And let's not forget Karl Rove.

Sandy Adams, Florida

Robert Aderholt, Alabama

Todd Akin, Missouri

Rodney Alexander, Louisiana

Michele Bachmann, Minnesota, Chairman

Roscoe Bartlett, Maryland

Joe Barton, Texas

Gus Bilirakis, Florida

Rob Bishop, Utah

Diane Black, Tennessee

Michael C. Burgess, Texas

Paul Broun, Georgia

Dan Burton, Indiana

John Carter, Texas

Bill Cassidy, Louisiana

Howard Coble, North Carolina

Mike Coffman, Colorado

Ander Crenshaw, Florida

John Culberson, Texas

Jeff Duncan, South Carolina

Blake Farenthold, Texas

Stephen Fincher, Tennessee

John Fleming, Louisana

Trent Franks, Arizona

Phil Gingrey, Georgia

Louie Gohmert, Texas

Vicky Hartzler, Missouri

Wally Herger, California

Tim Huelskamp, Kansas

Lynn Jenkins, Kansas

Steve King, Iowa

Doug Lamborn, Colorado

Jeff Landry, Louisiana

Blaine Luetkemeyer, Missouri

Kenny Marchant, Texas

Tom McClintock, California

David McKinley, West Virginia

Gary Miller, California

Mick Mulvaney, South Carolina

Randy Neugebauer, Texas

Rich Nugent, Florida

Steve Pearce, New Mexico

Mike Pence, Indiana

Ted Poe, Texas

Tom Price, Georgia

Denny Rehberg, Montana

Phil Roe, Tennessee

Dennis Ross, Florida

Ed Royce, California

Steve Scalise, Louisiana

Tim Scott, South Carolina

Pete Sessions, Texas

Adrian Smith, Nebraska

Lamar Smith, Texas

Cliff Stearns, Florida

Tim Walberg, Michigan

Joe Walsh, Illinois

Allen West, Florida

Lynn Westmoreland, Georgia

Joe Wilson, South Carolina

America...are you going to vote these people out of office in 2012 or not? In the meantime, call, fax these Tea Party elected Congressman and tell them to STOP destroying America ! You can contact them here at either House.Gov or Senate.gov:

House.gov

Senate.gov

How they ever got elected totally amazes me. Were Americans smoking something when they elected these idiots to office? They are an embarassment to America.

Those are the facts, those are the truth America!

And one last request...please email your family and friends this column. Here is the URL link:

http://www.dldewey.com/jobs.htm

Help them learn the what the real facts are and especially truth.

~ David Lawrence Dewey

It's up to you America!

Now ACT - Let's stop this madness of NOT solving our country's problems when it is simple,

but that would be to simple.... truth, honesty and common sense. It's jobs creation America is the most important things to do !

But that will not happen until you do something about it.

Send an email of the link to this article, http://www.dldewey.com/jobs.htm to family and friends

Update July 16, 2011

I received the following email from several of my readers who had received it from someone else. I have no idea who wrote it, but it is

so well written and since I received it from so many of my readers, I am including it in this column. I believe this pretty much sums up what

most Americans are feeling towards their elected Congressmen in Washington. After you read this, you might want to send an email to your family and friends concerning this article and this email and also send it to your Congressmen.

An "Entitlement???"

What the hell is wrong here?

Remember, not only did you contribute to Social Security but your employer did too. It totaled 15% of your income before taxes. If you averaged only 30K over your working life, thatís close to $220,500. If you calculate the future value of $4,500 per year (yours & your employerís contribution) at a simple 5% (less than what the govt. pays on the money that it borrows), after 49 years of working (me) you'd have $892,919.98. If you took out only 3% per year, you receive $26,787.60 per year and it would last better than 30 years, and thatís with no interest paid on that final amount on deposit! If you bought an annuity and it paid 4% per year, you'd have a lifetime income of $2,976.40 per month. The folks in Washington have pulled off a bigger Ponzi scheme than Bernie Madoff ever had.

Entitlement my ass, I paid cash for my social security insurance!!!! Just because they borrowed the money, doesn't make my benefits some kind of charity or handout!! Congressional benefits, aka. free health care, outrageous retirement packages, 67 paid holidays, three weeks paid vacation, unlimited paid sick days, now that's welfare, and they have the nerve to call my retirement entitlements !!!!!!.....scroll down..............

Emergency Rooms for their ( Congressmen ) general health care - At just one hospital the cost to tax payers totaled over 25 million a year!!!

Someone please tell me what the HELL's wrong with all the people that run this country ! ! !

We're "broke" & can't help our own Seniors, Veterans, Orphans, Homeless etc., ? ? ?

In the last months we have provided aid to Haiti, Chile, and Turkey. And now Pakistan home of bin Laden. Literally, BILLIONS of DOLLARS ! ! !

Our retired seniors living on a 'fixed income' receive no aid nor do they get any breaks while our government and religious organizations pour Hundreds of Billions of $$$$$$'s and Tons of Food to Foreign Countries!

They call Social Security and Medicare an entitlement even though most of us have been paying for it all our working lives and now when its time for us to collect, the government is running out of money. Why did the government borrow from it in the first place?

We have hundreds of adoptable children who are shoved aside to make room for the adoption of foreign orphans.

AMERICA: a country where we have homeless without shelter, children going to bed hungry, elderly going without 'needed' meds, and mentally ill without treatment - etc,etc.

YET......................

They have a 'Benefit' for the people of Haiti on 12 TV stations, ships and planes lining up with food, water, tents clothes, bedding, doctors and medical supplies.

Imagine if the *GOVERNMENT* gave 'US' the same support they give to other countries.

SAD?

YEAH, OK, SO WHEN DO WE GET PISSED AND DO SOMETHING ABOUT IT ? ? ?

99% of people won't have the guts to forward this.

I'm one of the 1% -- I Just Did

- End of Email -

The above email I received from several readers pretty much sums up what most Americans feel concerning this issue.

Again America, sit back and do nothing and the same political dogery will continue in Washington and you will continue to be screwed.

~ David Lawrence Dewey

Also, I would like to take this time to introduce you a friend of mine, Author and Painter, Paul Hampton Crockett. Paul is a brilliant painter who has painted beautiful spiritual paintings that touch your soul.

In addition, he is publishing online his book,

"Death is an Impostor: Life, Death, and the Path of the Heart ".

You can read his soul touching inspirational book about Paul's life at http://deathisanimpostor.wordpress.com/

Paul also writes a blog which you can read here: http://growingintothemystery.com/

Also, visit his painting website at: http://www.crockettartworks.com/

Here are just a couple of Paul's breath taking spiritual paintings

Until Next Time...

~David Lawrence Dewey

IMPORTANT UPDATE:

Make sure you read about the new documentary

Read About the Film - Click Here

Do you want to die young with a diseased heart?

Develop needless high blood presure?

Develop diabetes type II ?

If not - then you need to watch this new documentary !

THE FILM HAS WON FIVE FILM AWARDS !

|

Would you like to save up to 25% on your gasoline cost in your car or truck?

Then read what actual users of this

phenomenal device are raving about !

CLICK HERE

|

Improve your health with these amazing water wands !

The water wand introduces passive natural energy waves into clean drinking water, fruit, vegetable and vitamin drinks. This process causes water molecules to shed excess minerals and other substances, which break down into finer more usable nutrients. Since the water molecule becomes lighter, you can drink more liquids. This process balances pH, transports nutrients, and absorbs more waste in the body at a faster rate.

Drinking more water and fluids helps increase your rate of hydration, assimilation of nutrients and elimination (detoxification). This subtle

energy is discernable and gives a feeling of well-being.

Watch actual videos of how this transformed water affects

red blood cells before and after use.

CLICK HERE

|

Do you care about your health, the health of your children, your family?

Then make sure you read my column:

Hydrogenated Oils - Silent Killers

Learn the truth about these deadly oils in our food supplies

Read about Greta Ferebee's and my efforts in a nationwide petition campaign to get these and other toxins out of the food supply. VISIT our website:

DoWeCare.org

*The claims made about these products on or through this site have not been evaluated by the United States Food and Drug Administration and are not approved to diagnose, treat, cure or prevent disease. The information provided on this site is for informational purposes only and is not intended as a substitute for advice from your physician or other healthcare professional or any information contained on or in any product label or packaging. You should not use the information on this site for diagnosis or treatment of any health problem or for prescription of any medication or other treatment. You should consult with a healthcare professional before starting any diet, exercise or supplementation program, before taking any medication, or if you have or suspect you might have a health problem.

In the United States, medical diagnosis and treatment is constrained by law to be the exclusive purview of state licensed practitioners. The diseases discussed on this site are serious, sometimes life threatening matters. Neither the content nor the intent of this column may or should be construed as the giving of medical advice or as recommending any treatment of any kind. The purpose of this column is to support informed discussions, to provide medical research links and and to help the patient identify the doctors who keep up with advances in their field.

| © All Rights Reserved. Use of these articles is for personal

use only. Any other use is strictly prohibited. Newspapers, syndicates or

publications wishing to print his columns, email your request with details

to Mr. Dewey's agent. Email Contacts

for DL Dewey. For any other use, DLDEWEY for permission to use column

or columns, detailing your request to use which column or columns and for

what purpose. |

©2011-2013

Rocky Mountain Publicity

Last Modified: June 1, 2013

|

Food For Thought

Food For Thought